- In order to understand how our business is tracking, we need to be able to read our balance sheet.

- What are assets, liabilities and owner’s equity? What equations should we keep in mind?

- Read on to learn exactly what a balance sheet is and the information you need to understand as a business owner.

When most small businesses are asked, “How is the business going?” The first things that are thought about are usually:

- What is the current balance of my bank account?

- How much did I do in sales last month?

- Did I manage to take home any money this month?

While those are good indications of how business is travelling, it doesn’t give the whole picture of how healthy your business is.

Understanding how to read your balance sheet will ensure you understand how your business is tracking.

So, what is a balance sheet and what does it show?

What Is a Balance Sheet?

At the very basic level, a balance sheet shows what assets your business controls and who owns them.

While your profit and loss statement will show you how a business has performed over a period, the balance sheet presents the financial condition at a single point in time. This is normally at the end of a month or quarter but can be any date in time if everything is reconciled.

The purpose of a balance sheet is to show exactly what things of value your entity controls (known as assets) and who owns these assets – its either someone else (liabilities) or the business owner (Owner’s equity).

How to Read a Balance Sheet in Australia

The format of a balance sheet in Australia is broken down into three sections:

- Assets

- Liabilities

- Owner's equity

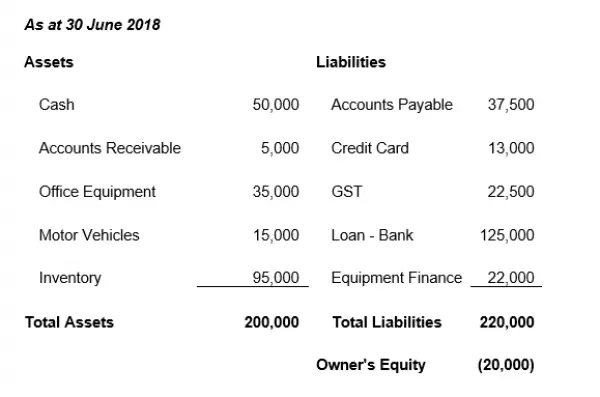

Below is an example of a balance sheet format and the information it includes:

What Are Assets?

An asset is anything of value that your business controls, even if the business doesn’t technically own it. Examples of assets include cash, plant and equipment, inventory, accounts receivable, GST and income tax refunds. Assets add value to the business and can provide future economic benefit.

It is important to remember, that even if the business doesn’t own the assets in financial terms if the item is under the possession and control of the business it is deemed an asset of that business.

For instance, if you buy office equipment for $60,000, which is 100% funded by a loan from the bank, the company still has an asset of $60,000 on the balance sheet. The borrowing is accounted for under our next section – liabilities.

What Are Liabilities?

Liabilities are obligations that you owe to other entities. This could be in the form of loans, credit cards, overdrafts, accounts payable, or GST and income tax obligations. In our example above, the $60,000 borrowed to purchase the office equipment would be considered a liability.

Obligations relating to employees such as pay as you go withholding, superannuation payable, wages payable are classified as liabilities until they have been paid.

While liabilities are obligations that normally arrive because of a past transaction, they can also include amount received in advance for future services. This is usually called Income Received in Advance.

What Is Owner’s Equity

The Owner’s Equity is the difference between the assets and liabilities of the business. If the total assets exceed the total liabilities, the owner’s equity represents the portion of the business assets that the Owner owns free and clear.

If liabilities exceed assets, the owner’s equity balance will be negative, which represents the amount the Owner has had to contribute to cover the asset shortfall of the business.

Why Is it Called a Balance Sheet?

It's termed a balance sheet because the two sides always add up to the same amount. From one side the assets with liabilities and owner’s equity on the other. The balance sheet equation is always:

Assets = Owner’s Equity + Liabilities

In the balance sheet above, you can clearly see that this holds true:

200,000 (assets) = 160,000 (liabilities) + 40,000 (owner’s equity)

What the balance sheet equation is saying is that assets fall into two categories – those owned by a creditor (liabilities) or owned by you (owner’s equity).

The most common experience we have with the concept of equity is in our home mortgage. If your home (asset) is worth $500,000 but you owe the bank $350,000 (liability) you have $150,000 equity (owner’s equity). Your balance sheet works on the same principle!

So why is it important to know your balance sheet?

Your balance sheet shows you how much of your assets that you own. So if the business were too fall on hard times and you had to liquidate all assets to pay out liabilities, it shows how much you would be left over.

It also gives you a whole picture of your business. Let’s look at our example above but make some changes. Our balance sheet looked healthy with owner’s equity showing $40,000. But what if it looked like this?

A lot of business owners would be excited with a bank balance of $50,000! And in our previous example, the bank balance reflected the healthy owner’s equity balance. But as this updated example shows, a $50,000 bank balance doesn’t necessarily mean that the business is healthy. With high liabilities, the owner’s equity is negative, meaning the business owner is having to prop the business up.

In the End, It all Balances Out

While balance sheets can be far more detailed with the classification of assets and liabilities as either current or non-current, writing off the value of assets with accumulated depreciation, and concepts such as retained profits and owner distributions, the above information will help you read your balance sheet to get a gauge on how your business is travelling! Remember the balance sheet equation – assets = liabilities + owner’s equity and you can’t go wrong!

Do you need help with

accounting?

There are 416 accountants on standby